The time is now

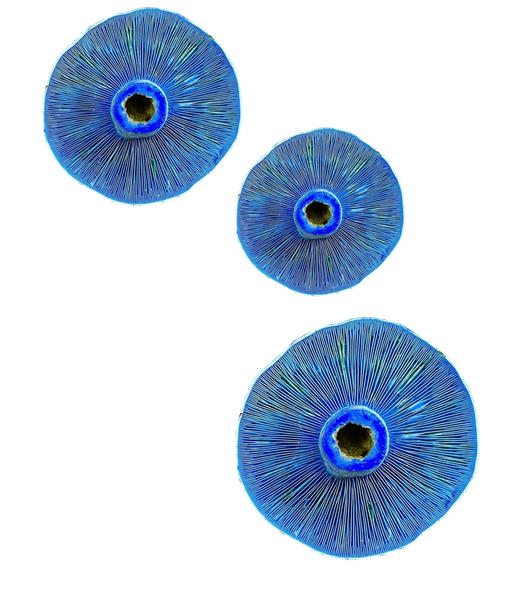

Psychedelic compounds can lead to major breakthroughs in the treatment of depression, anxiety, and addiction, as recognized by the FDA and the scientific community. We work with science-led teams advancing and redefining the standard of patient care.

Clinical results are impressive

Liberalisation is expanding

Regulation is on the way

Our investments

Average ticket size

£150k - £1m

Target stage

Pre-Seed to Series A

Target markets

Global, with a European tilt

Investment categories

Compounds, clinics and care delivery, digital therapeutics and platforms

Our ecosystem

Specialist

Largest European VC fund with a reputation for discipline and diligence

Network

We work closely with leaders in this sector, with relationships going back 15 years

Ecosystem

We're building an ecosystem. We provide more than just capital, working with founders from scratch to success

Our portfolio

Our partners

We are actively involved in shaping policy, working closely with our partners at Drug Science and the International Therapeutic Psilocybin Rescheduling Initiative, among other leading partners in psychedelic research

Our team

Clara Burtenshaw

Investor

Biotech and life sciences investor with significant transactional, VC, IP and operational experience. Voted among the top 16 most influential women in psychedelics by Business Insider

- Board advisor to the International Therapeutic Psilocybin Rescheduling Initiative

- 5 years as GC at a PE-backed major retail group

- 5 years at Slaughter and May, focusing on M&A, IPOs and corporate finance

- Graduate from Oxford University, and NYU School of Law

Sean McLintock

Investor

Entrepreneur and longtime investor with deep wealth planning, trade finance and family office experience

- Previously at Andela, a high growth technology company backed by Google Ventures

- Founder of ThreeDots, a CBD beverage company in the UK

- Graduate of Stellenbosch University, Chicago Booth Business School, and Columbia University

Fergus Argyle

Investor

Experienced public and private company investor, across both credit and equity markets. Deep sector expertise in broad technology, med-tech, pharmaceuticals and biologics

- Career spanning roles at Blackrock to leading positions in boutique investment firms in London and Asia

- Graduate of Oxford University, and studied at the University of Damascus and Said Business School

Dr. Peter Crane

Chemical biology

Venture partner with healthcare investment and pharmaceutical expertise:

- Prior roles with corporate strategy and deep technology start-up accelerators

- DPhil in Chemical Biology from Oxford University and masters in chemistry (top of year) from Warwick University

Dr. Willem Hendrik Gispen

Neuropharmacology

Medical biologist and neuroscientist with distinguished academic positions including:

- Head of the Department of Molecular Neurobiology; Dean of the Faculty of Medicine; and Rector Magnificus of Utrecht University

- Director of the Rudolf Magnus Institute for Neuroscience

- President of the Federation of European Neuroscience Societies

- Editor in chief of the European Journal of Pharmacology

Isabel Fox

Advisory Board

Council member at Innovate UK and General Partner at Outsized Ventures

Prior to founding Outsized Ventures, Isabel was head of Venture Capital at White Cloud Capital here she focused on early stage investments in life sciences and healthcare

Lomax Ward

Advisory Board

Co-Founder and General Partner at Outsized Ventures fund focussing on human health

Previously a healthcare and life science investor at White Cloud and a corporate lawyer at Slaughter and May

Christina Sass

Advisory Board

Executive Coach with Talentism and the Co-Founder and Chair of Andela

Christina and her team raised over $181M in venture capital and grew to 2k+ employees with a $50M run rate in 6 years

Formerly at the MasterCard Foundation and the Clinton Global Initiative

Featured in

Media

Contact us

Sign up to our newsletter

© 2021 All Rights Reserved | Neo Kuma Ventures

71-75 Shelton Street, Covent Garden, London WC2H 9JQ

Neo Kuma Ventures LLP is an Appointed Representative of The Fund Incubator Limited which is authorised and regulated by the Financial Conduct Authority (FRN 208716)